18 Aug 401(k) Rollover Tax Implications Every Investor Needs to Know

If you have a 401(k) you’ve left behind with a past employer, and you’re wanting to roll it over, it’s critical to understand the 401(k) rollover tax implications BEFORE you make the move.

Because the amount of taxes you will pay all comes down to HOW you roll over or withdraw your funds.

Each has its own implications, so you need to plan your decision wisely. Taxes can take a HUGE bite out of your rollover amount if you are not careful – and, therefore, impact how much money you have in retirement.

Keep reading to better understand 401(k) rollover tax implications and how the type of rollover may affect your next tax bill.

Types of 401(k) Rollovers

Before we get to 401(k) rollover tax implications, it’s important to understand the 2 types of rollovers: direct and indirect.

Direct Rollovers

A 401(k) direct rollover occurs directly between the trustee, or custodian, of your old retirement plan and the trustee of your new plan.

You never actually receive the funds or have control of them, so a trustee-to-trustee transfer is not treated as a distribution.

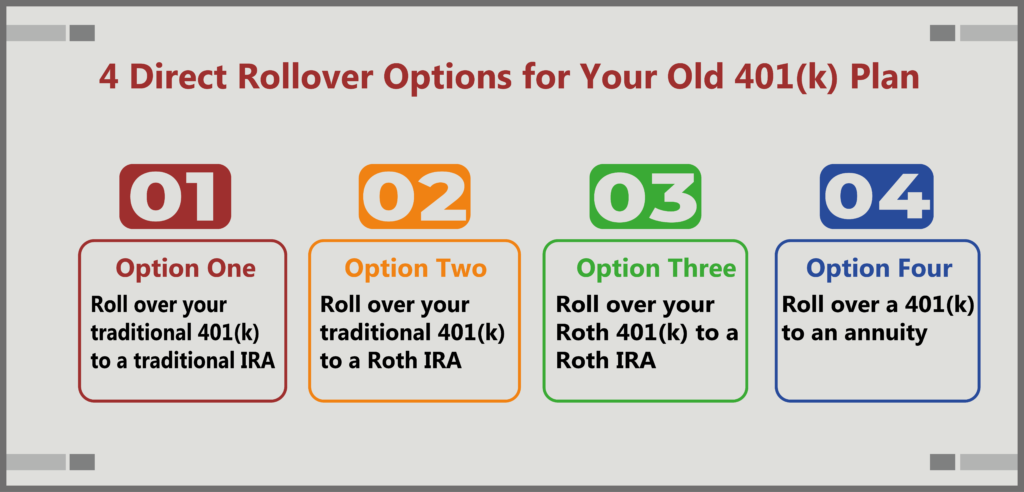

You can directly roll over to an IRA, ROTH IRA, annuity, or your new employer’s 401(k).

Indirect Rollovers

With an indirect 401(k) rollover, you receive a distribution from your retirement plan, and, then, to complete the rollover transaction, you make a deposit into the new retirement plan that you want to receive the funds.

You must generally complete the rollover within 60 days of the date the funds are paid from the distributing plan.

If you fail to complete the rollover or miss the 60-day deadline, all or part of your distribution may be taxed and subject to a 10% early distribution penalty (unless you are age 59½ or another exception applies).

If you opt for an indirect rollover, your employer must withhold 20% of the payment for income taxes. After taxes are taken out, you will be sent the funds via check.

This means that, if you want to roll over your entire distribution, you’ll need to come up with that extra 20% from your other funds (you’ll be able to recover the withheld taxes when you file your tax return).

Also, the IRS only allows for one indirect rollover per 12-month period.

[Related Read: Direct and Indirect 401(k) Rollovers: What’s the Difference?]

Find Out More about Indirect vs Direct Rollovers and Discover the #1 401(k) Rollover Mistake to Avoid.

401(k) Rollover Tax Implications

#1 Taxes ARE Due on Every Withdrawal from Your 401(k)

Should you decide to keep the money instead of rolling over your 401(k) into an IRA or other retirement investment vehicle, the amount will be taxed as normal income in the year you withdraw the funds.

#2 Taxes ARE NOT Due on a DIRECT Rollover from Your 401(k) to an IRA

Since the funds transfer from custodian to custodian, there will be no tax consequences.

#3 Taxes Are WITHHELD from EVERY INDIRECT Rollover

An indirect rollover is when the custodian sends you the rollover check, and you have 60 days to deposit it back into an IRA account. In this process, the IRS mandates that custodians withhold 20% for taxes.

After taxes are taken out, you will be sent the remaining funds by check.

This means that, if you want to roll over your entire distribution, you need to come up with that extra 20% on your own.

You will be able to recover the withheld taxes when you file your tax return, but it’s up to you to cover the 20% for taxes owed.

So, if you roll over $50,000, you would have $10,000 withheld – and have to come up with $10,000 of your own money in order to complete the rollover.

No Comments