Many people nearing retirement are going to need all the Social Security benefits they can get – and that means finding ways now to increase social security benefits before retirement.

According to a study conducted by the The Center on Budget and Policy Priorities, Social Security provides at least 50% of retirees’ income. For about 1 in 4 seniors, it provides at least 90% of income.

With experts suggesting people need to bring in approximately 80% of their pre-retirement income to have a fairly comfortable retirement – well, let’s face it – Social Security benefits are probably NOT going to reach 80% of anyone’s pre-retirement income.

If you want to increase Social Security benefits before retirement, you need to be intentional about when and how you choose to collect benefits.

Let’s dive in, shall we?

There are two main ways to increase your Social Security benefits before you retire:

#1 Work the maximum 35 years that Social Security calculates.

#2 Delay claiming your benefits to the most beneficial time.

The easiest way to increase your Social Security benefits is to work the 35 years that Social Security counts – and make as much as you can possibly make in those years.

Your Social Security benefits are based on your lifetime earnings.

Your actual earnings are adjusted or “indexed” to account for changes in average wages since the year the earnings were received.

Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most money.

Your highest 35 years of earnings are used to calculate your benefits. This includes years with zeros!

A quick way to increase your benefits is to replace those zero years with actual earnings.

Also, you can replace the smaller earning years with larger earnings. You may have to pick up extra hours at work or take on a side hustle to improve your benefits for life.

Working longer and harder may not be what you want to do right now, but it can help increase Social Security benefits before retirement.

Use the statement from SSA.gov to see how many zero or low years you have, and then replace them.

Waiting to claim Social Security benefits is not a popular choice. But, by waiting, your benefits are increased by a certain percentage for each month you delay starting your benefits.

You can begin taking benefits as early as age 62 and 60 for widow or survivor benefits.

Each month you wait to claim benefits, you increase your benefits by 0.5%.

Waiting until your full retirement age (FRA) means you could receive about 30% MORE in monthly benefits for the rest of your life.

If you still aren’t ready to retire, you can increase your benefits all the way up to age 70, when you must turn on your benefits.

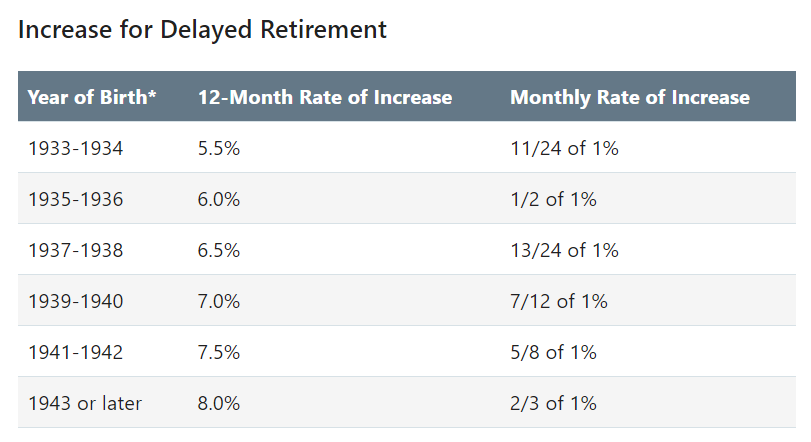

You will average around an 8% increase annually from full retirement age up to age 70.

No Comments