23 Jun Types of IRAs Defined

Most people know the traditional IRA and the Roth IRA. But few realize there are numerous types of IRAs – 6 to be exact.

The 6 types of IRAs were designed for different purposes. Specifically, there are 4 types of IRAs for individuals and 2 for small businesses.

When it comes to retirement saving, it should be all about you. The financial product – in this case, the type of IRA – you select should be based on your goals and what you intend to use the money for.

Whether you have an IRA now or not, it’s important to understand the different types so you ensure you’re invested in one that’s the best fit for your retirement goals.

Let’s break it down, shall we?

Traditional IRA

Anyone with earned income can contribute to a traditional IRA. Money invested goes into the account pre-tax, which gives you an immediate tax deduction (subject to income limits).

You’re only taxed when you take out the money.

This is the key difference between the traditional and Roth IRA.

Since an IRA is designed for retirement, you are technically not supposed to take withdrawals until you reach a certain age.

For a traditional IRA, you may make withdrawals without penalty after the age of 59½. However, if you withdraw before age 59½, you are subject to a 10% penalty.

With a traditional IRA, you are also mandated to take distributions (RMDs) once you reach age 72.

No matter when you withdraw, before age 59½ or after, your withdrawal will be taxed as earned income in the year the withdrawal is taken.

Contributions grow tax-deferred in a traditional IRA.

Deductible Traditional IRA Phaseouts

Contribution limits for 2022 are $6,000, with an additional $1,000 allowed if you are 50 and over.

For singles and heads of household who are covered by a workplace retirement plan, such as a 401(k), and contribute to a traditional IRA, the phaseout range is between $68,000 and $78,000, up from $66,000 and $76,000 in 2021.

For 2022, the adjusted gross income (AGI) phaseout range for married couples filing jointly who are contributing to a traditional IRA is between $109,000 and $129,000 for 2022, up from $105,000 and $125,000 in 2021.

If you contribute to an IRA but are not covered by a workplace retirement plan and are married to someone who is, the deduction is phased out if your joint income is between $204,000 and $214,000 in 2022. This is up from $198,000 and $208,000 in 2021.

Roth IRA

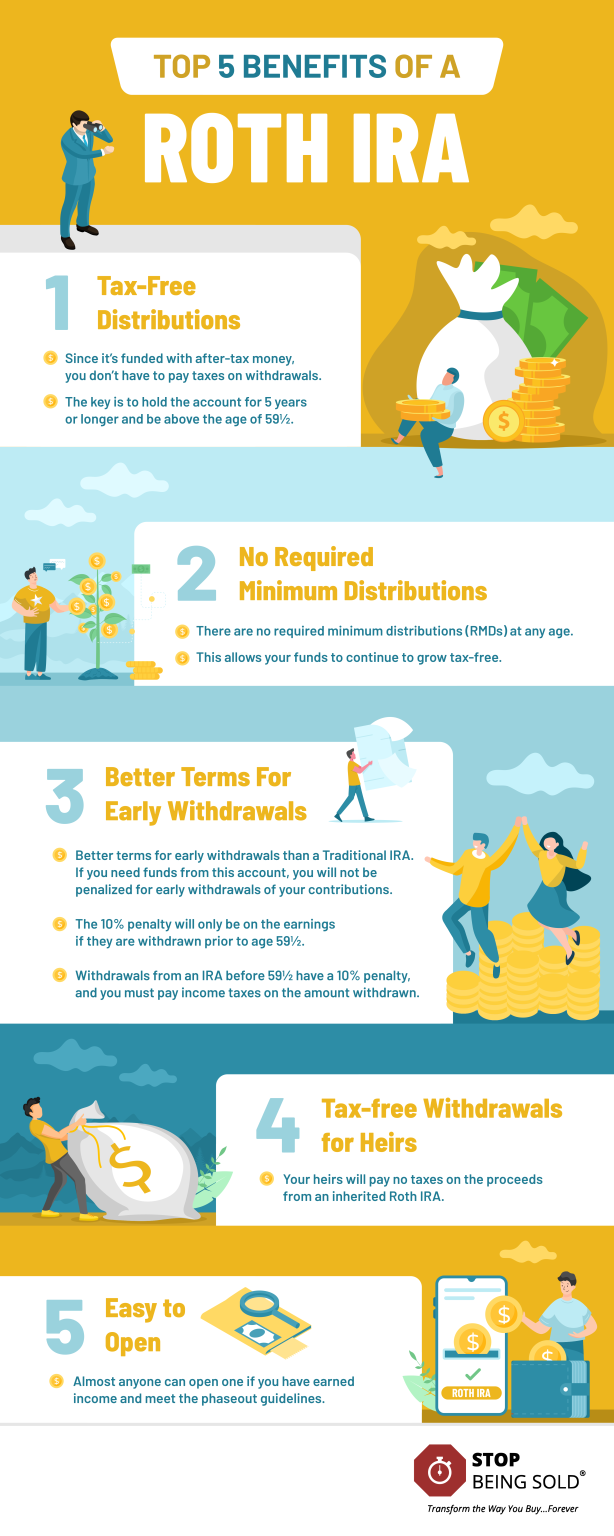

The Roth IRA is similar to a traditional IRA but with a few key variances.

The KEY benefit of the Roth IRA is that it allows for after-tax contributions, and these contributions grow tax-free.

Because your contribution is made after taxes are paid, you won’t get a tax break like you do with the traditional IRA.

However, you will be able to withdraw the money penalty-free and tax-free if you are older than age 59½ and have held the account for 5 years or more.

Also with the Roth IRA, there are no required minimum distributions (RMDs).

This allows your funds to continue to grow tax-free. It also means, when the market is high or down, you aren’t forced to sell when you don’t want to – or when it’s not advantageous for you to do so.

When comparing Roth IRAs to traditional IRAs, another benefit to the Roth is the better terms for early withdrawals.

If you need the funds for an emergency, to purchase your first home, or start a business, the Roth IRA allows you to pull money out with a 10% penalty on the earnings if you withdraw prior to age 59½.

Because the Roth is funded with after-tax dollars, if you are under 59½, you only pay a penalty on the earnings. You will also have to pay income tax on the amount withdrawn.

Here is a breakdown of the Roth IRA withdrawal rules:

If you take withdrawals from a Roth IRA you’ve had less than 5 years.

If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is 5 years old, the earnings may be subject to taxes and penalties. You may be able to avoid penalties (but not taxes) in the following situations:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You use the withdrawal to pay for unreimbursed medical expenses or health insurance if you’re unemployed.

If you take withdrawals from a Roth IRA you’ve had more than 5 years.

If you’re under 59½ and your Roth IRA has been open 5 years or more, your earnings will not be subject to taxes if you meet one of the following conditions:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You use the withdrawal to pay for unreimbursed medical expenses or health insurance if you’re unemployed.

If you are over age 59½ and you want to withdraw for whatever reason, you will not have to pay the 10% penalty or income tax.

Unlike traditional IRAs, your heirs will pay no taxes on the proceeds from an inherited Roth IRA.

Roth IRA Phaseouts

Contribution limits for 2022 are $6,000, with an additional $1,000 allowed if you are 50 and over.

The phaseout range for married couples filing jointly who are covered by a workplace retirement plan and contribute to a Roth IRA in 2022 will increase.

For 2022, it will be between $204,000 and $214,000, up from $198,000 and $208,000 in 2021.

For heads of household or those filing as single, the phaseout range is between $129,000 and $144,000 in 2022, up from $125,000 and $140,000 in 2021.

Remember, you can still contribute to an IRA even if you earn too much — it’s just nondeductible.

Spousal IRA

Spousal IRAs allow a stay-at-home parent to open a retirement account in their own name and works the same way as a Roth IRA.

IRA stands for Individual Retirement Account; therefore, a Spousal Roth IRA is not a joint account.

It is a separate individual IRA for the non-working spouse that is funded by the working spouse.

As long as one person in the household has earned income and you file a joint tax return (tax filing status must be “married filing jointly”), you can open and contribute to a Spousal IRA.

Or the working spouse can contribute to a spousal Roth IRA on behalf of the spouse who does not work.

In order to qualify, you MUST file a joint tax return.

This means if you get divorced, you cannot fund a Spousal IRA. If you do separate in the future, the money already in the Spousal IRA belongs to the spouse in whose name it is (the non-working spouse).

In 2022, the annual contribution limit for IRAs, including Roth and traditional IRAs, is $6,000. If you are age 50 or older, you can contribute an additional $1,000 annually for a total of $7,000.

Note: The amount of your combined contributions can’t be more than the taxable compensation reported on your joint return.

Watch the video below for a more detailed discussion.

Self-Directed IRA

As the name implies, a self-directed IRA is one you direct – not an advisor. It allows you to invest assets not allowed in most traditional IRAs, such as:

- Cryptocurrency.

- Real estate.

- Gold, silver, palladium, etc.

- Tax liens.

- Limited partnerships.

- Other alternative investments.

Self-directed IRAs do NOT allow you to invest in collectables such as art, antiques, rugs, any alcoholic beverage, and anything else the IRS says is a collectible. The other asset the IRS will not let you invest in is Life Insurance.

There are additional rules and prohibited transactions that – if not adhered to – can immediately make your entire IRA taxable.

Should this happen, you will have to pay taxes and, if you’re under 59½, you’ll have to pay the 10% penalty.

Prohibited transactions include:

- Lending or giving money to a disqualified person.

- Transferring assets from the IRA to a disqualified person.

- Selling assets you already own personally to the IRA.

Self-directed IRAs are becoming more and more popular, as people want more control over their investments and want more choice in investments.

However, they are not right for everyone.

They are ideal for someone who wants to be active in their retirement investment future. So –if you love investing, like researching investments, will stay on top of IRS rules, and want the potential to increase returns – then it may be a good choice for you.

On the flipside, a self-directed IRA is not right for someone with little or no investment experience. If you don’t pay attention to details or don’t have the time to monitor and research investments and stay abreast of IRS rules, then this is probably NOT right for you.

The upside to self-directed IRAs is that you may make higher returns because the assets invested are not typically found in traditional or Roth IRAs. And you have total control over your retirement savings.

The downside of self-directed IRAs includes:

- Custodians cannot by law give you investment advice.

- You must do it all (hence the name!).

- May have higher fees, depending on the custodian and the assets held.

- Could be less liquid.

- Compliance and following the IRS rules are on you.

The annual contribution limit for self-directed IRAs is $6,000. If you are age 50 or older, you can contribute an additional $1,000 annually for a total of $7,000.

Check out this video for more info on self-directed IRAs.

SEP IRA

Also called a Simplified Employee Pension Plan, the SEP IRA is for small businesses.

It allows the employer to set up traditional IRAs for themselves and employees. There is no limit on the size of the business, and that means you can be a sole proprietor and easily set one of these up.

A benefit to the SEP IRA is that you don’t have the startup and ongoing costs of traditional workplace plans, like 401(k)s.

Here’s the catch: a SEP only allows employer contributions. This means the employer has to contribute on behalf of the employees. Employees cannot contribute to this plan.

All employer contributions must be equal to all eligible employees. So if you contribute $1,000 for your plan, you have to put in $1,000 for all other employees.

There are also maximum limits to eligibility. These include:

- You must be 21 years of age.

- You must have worked for the employer for 3 of the last 5 years.

- You must make at least $650 in compensation per year.

These are max limits – the employer can make these requirements less and even have no limits at all. So, if you want every new employee eligible from day one, you can choose to do so.

Contribution limits are based on the first $305,000 of compensation for 2022. Annual limits are the smaller of $61,000 or 25% of your income. If you are self-employed and you make $100,000, you can put in $25,000, or 25% of your income.

The employer can deduct contributions and get a tax deduction, and employees get tax breaks because the money goes in pre-tax.

Also, unlike some 401(k)s, employees are 100% vested.

A big benefit of the SEP IRA is the flexible contributions. Let’s say it’s a good year and you want to put more money in. You can. And if the next year isn’t so good, you can contribute less.

With the SEP IRA, you are NOT mandated to put the same amount in each year.

SIMPLE IRA

SIMPLE stands for Savings Incentive Match Plan for Employees, and it’s designed for smaller businesses under 100 employees.

This type of IRA for small business differs from the SEP in that it allows both employers and employees to contribute.

Employers must contribute to this plan. SIMPLE IRA contributions are not flexible like they are with the SEP IRA – there are set percentages.

Employer required contributions include matching contributions up to 3% OR 2% nonelective contributions (employees who don’t contribute). This means an employee who does not contribute still gets 2%.

Also, employees are 100% vested at any time.

No Comments