01 Sep Why Should I Open a Roth IRA?

Want to set up an IRA, but aren’t sure whether a Roth IRA is right for your retirement goals? Fret not – we’ve got you covered.

Keep reading for a complete breakdown of everything you need to know about the Roth IRA.

What Is a Roth IRA and How Does It Work?

A Roth IRA is an individual retirement account in which money grows tax-free. Because it’s funded with after-tax money, your withdrawals in retirement (after age 59½) are tax-free.

This is the key difference between the traditional IRA and the Roth – withdrawals in retirement are tax-free with the Roth and not with traditional IRAs.

A Roth IRA is also more flexible than other retirement accounts, like a 401(k) for example. You can invest in almost anything, like stocks, bonds, mutual funds, ETFs, and even real estate.

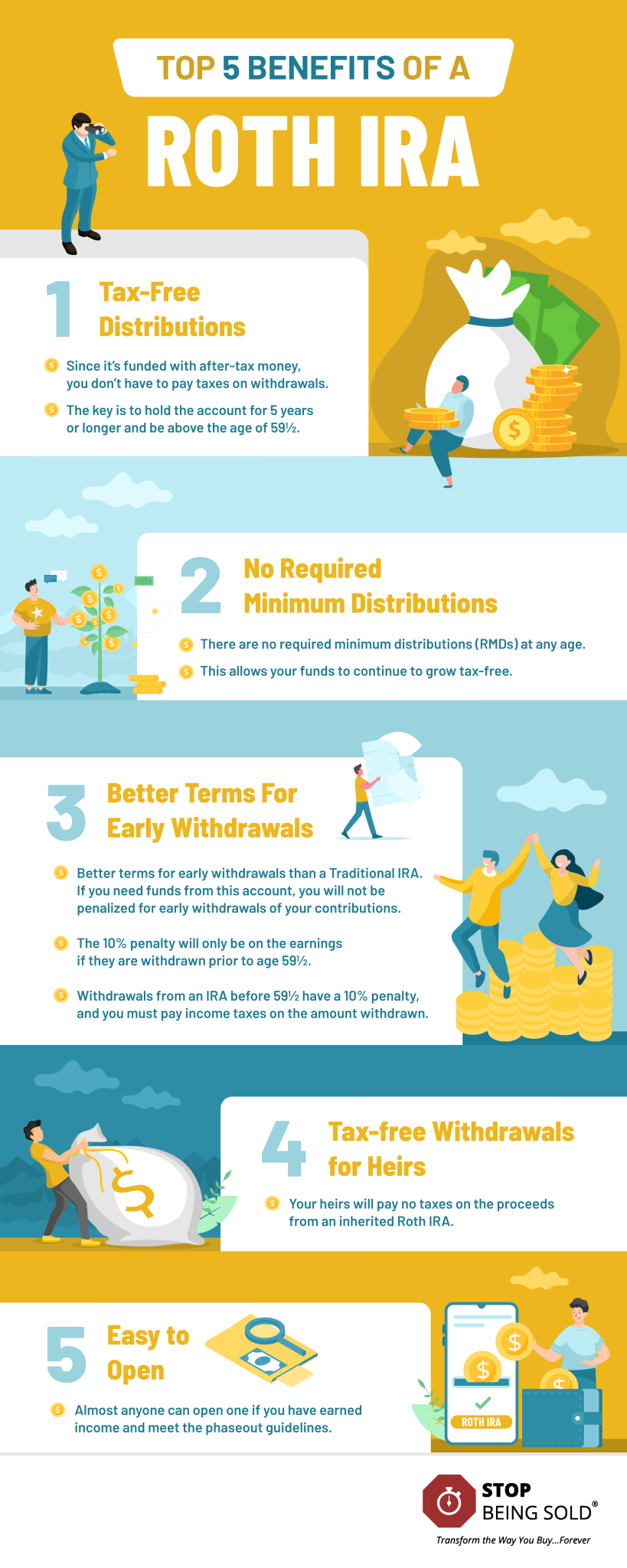

Advantages of the Roth IRA

Providing you qualify, there are numerous benefits to owning a Roth IRA. These include:

#1 Tax-free distributions

This is the #1 benefit of a Roth IRA. You funded this account with after-tax money, and, in retirement, your proceeds will be yours, free and clear of taxes. The key is to hold the account for 5 years or longer and be 59½ or older.

#2 No Required Minimum Distributions

Unlike the traditional IRA, there are no required minimum distributions (RMDs) required at any age. This allows your funds to continue to grow tax-free.

#3 Better Terms for Early Withdrawals

If you need funds from your Roth IRA, you will not be penalized for early withdrawals of your contributions.

The 10% penalty will only be on the earnings if they are withdrawn prior to age 59½. Withdrawals from an IRA before 59½ have a 10% penalty, and you must pay income taxes on the amount withdrawn.

#4 Tax-free Withdrawals for Heirs

Unlike traditional IRAs, your heirs will pay no taxes on the proceeds from an inherited Roth IRA.

#5 Easy to Open

Almost anyone can open one if you have earned income.

Contribution Limits

For 2022, the total contributions you make each year to all your Roth IRAs cannot exceed more than $6,000.

The catch-up contribution for those age 50 and older is $7,000.

You have until the next tax deadline to add to your Roth IRA. So, if you don’t max it out in the calendar year of 2022, you have until April 2023 to max it out.

Phaseout for Contributing to a Roth IRA

There are specific rules as to who can contribute to a Roth. It’s important to pay attention to these because should you enter or exceed the phaseout ranges, you can expect to pay a penalty.

The phaseout range for married couples filing jointly who are covered by a workplace retirement plan and contribute to a Roth IRA in 2022 is between $204,000 and $214,000.

For heads of household or those filing as single, the 2022 phaseout range is between $129,000 and $144,000.

These ranges are based on your MAGI, or modified adjusted gross income, which means your income after all deductions allowed by the IRS.

If at any time you enter or exceed the phaseout range, you will incur a 6% penalty per year for every year for all excess funds remaining in the Roth IRA.

Should this happen, you will have to remove the overages and interest earned by that year’s tax filing date.

If the amount you can contribute must be reduced, figure your reduced contribution limit as follows from the IRS:

1)Start with your modified AGI.

2) Subtract from the amount in (1):

- $204,000 if filing a joint return or qualifying widow(er)

- $-0- if married filing a separate return, and you lived with your spouse at any time during the year, or $129,000 for all other individuals.

3) Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow(er), or married filing a separate return and you lived with your spouse at any time during the year).

4) Multiply the maximum contribution limit (before reduction by this adjustment and before reduction for any contributions to traditional IRAs) by the result in (3).

5) Subtract the result in (4) from the maximum contribution limit before this reduction. The result is your reduced contribution limit.

What Are the Withdrawal Rules for a Roth IRA?

Roth IRA tax-free withdrawal and IRS penalty rules vary depending on your age, how long you’ve had the account, and other factors.

- Withdrawals must be taken after age 59½.

- Withdrawals must be taken after a 5-year holding period.

- There are exceptions to the early withdrawal penalty, such as a first-time home purchase, college expenses, and birth or adoption expenses.

Roth IRA Withdrawal Rules If You Are under Age 59½

You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. You may have to pay taxes and penalties on earnings in your Roth IRA, depending on the situation.

#1 If you take withdrawals from a Roth IRA you’ve had less than 5 years.

If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is 5 years old, the earnings may be subject to taxes and penalties.

You may be able to avoid penalties (but not taxes) in the following situations:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You use the withdrawal to pay for unreimbursed medical expenses or health insurance if you’re unemployed.

#2 If you take withdrawals from a Roth IRA you’ve had more than 5 years.

If you’re under 59½ and your Roth IRA has been open 5 years or more, your earnings will not be subject to taxes if you meet one of the following conditions:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You use the withdrawal to pay for unreimbursed medical expenses or health insurance if you’re unemployed.

Roth IRA Withdrawal Rules If You Are 59½ and Older

If you take withdrawals from a Roth IRA you’ve had less than 5 years, your

earnings will be subject to taxes but not penalties if you haven’t met the 5-year holding requirement.

If you take withdrawals from a Roth IRA you’ve had more than 5 years, you can withdraw money from a Roth IRA with no taxes or penalties if you’ve met the 5-year holding requirement.

No Comments