20 Jan Why Working with a Fiduciary Is CRITICAL to Your Financial Future

Working with a fiduciary advisor is critical to your financial future because it’s all about you, your goals, and what’s best for you – not for the advisor.

While the word fiduciary is more prevalent in ads and in email signatures of advisors than it once was, there’s still confusion around the term…and what it means.

If you think all advisors are fiduciaries, think again. They are not.

There are many conflicts of interest based on how an advisor is licensed.

Only registered investment advisors are required by law to act in the best interest of their clients.

Advisors who are not fiduciaries operate under what is called a suitability standard. This means the products they sell you must only be suitable – and do not have to be in your best interest.

If your financial advisor doesn’t have a fiduciary duty to you, he or she may be able to recommend investments or products that pay a bigger commission over ones that would be the best fit for you, which could cost you more.

In this article, we’re breaking down the definition of a fiduciary, comparing what it’s like to work with a fiduciary vs. a non-fiduciary, and important questions you need to ask before you work with an advisor.

By the end, you’ll understand why working with a fiduciary is critical to your financial future.

What Is a Fiduciary?

A fiduciary is a person or organization that acts on behalf of a person or persons and is legally bound to act solely in the client’s best interests.

A fiduciary manages property or money on behalf of someone else.

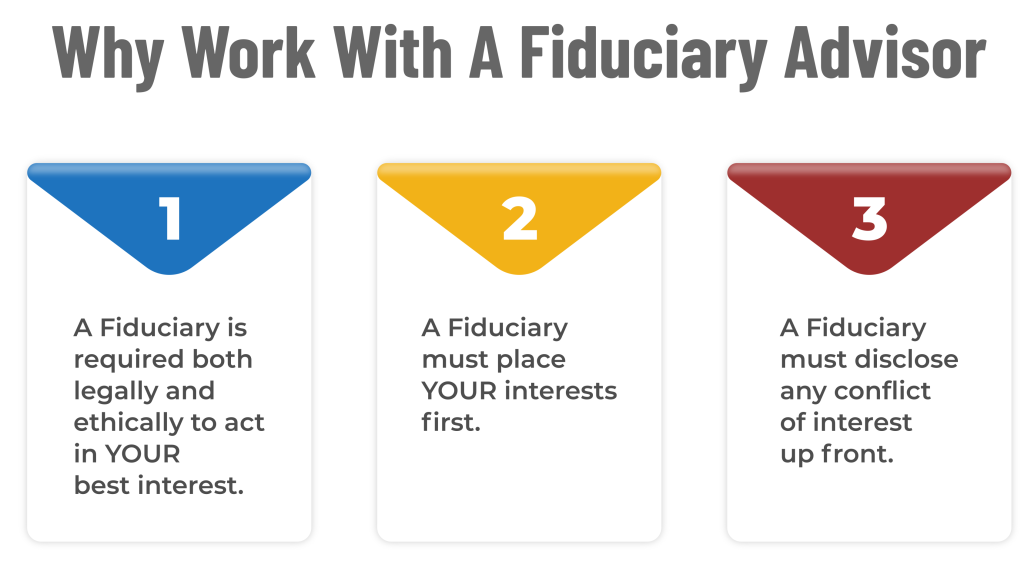

Specifically, a fiduciary…

#1 Is required both legally and ethically to act in the client’s best interests and NOT for his or her own interest or the interest of a company.

#2 Must place YOUR interests first.

#3 Must disclose any conflict of interest upfront.

Fiduciary advisors must only buy and sell investments that are the best fit for you and your financial goals.

They get paid a fee or a percentage of the assets rather than a commission, which means there’s no clouded judgment when selecting the best product for your situation and goals.

Nor can they push a specific product on you just because it’s suitable, but offers them a higher commission.

Should they breach their fiduciary duty, they are liable to be sued.

How Fiduciary Duty Works

Fiduciaries operate under both Duty of Care and Duty of Loyalty. Let’s break these down.

Duty of Care

Duty of Care requires fiduciaries to make decisions in good faith. The fiduciary must conduct research, understand the client’s goals and risk tolerance, and make an informed decision that’s in the client’s best interest.

Duty of Loyalty

Duty of loyalty seeks to prevent advisors from acting against the best interests of their clients or in a way that personally benefits themselves or their firms.

It’s All about Your Financial Future

The best way to drive home this statement is to compare what working with a fiduciary vs. a non-fiduciary looks like.

Let’s say you’ve left a job or recently retired and you want to roll over an old 401(k).

Here’s what should happen if you’re working with a fiduciary advisor. He or she will…

- Define your goals with the funds, now that you have left your employment.

- Find the best rates and terms of an IRA.

- Offer transparency in the results of the research for your plan.

- Compare these findings with the old 401(k) to see if the transfer is actually in your best interest.

- Charge you either a flat fee or a percentage of assets fee.

- Only make more money when he or she grows your account.

- Disclose any potential conflict of interest upfront.

In a nutshell, the fiduciary will act in your best interest when offering advice and recommending specific financial products.

On the other hand, here’s what it looks like to work with someone who is NOT a fiduciary. He or she may…

- Define your goals with the funds, now that you have left your employment.

- Determine your suitability for financial products.

- NOT have an incentive to disclose any potential conflicts of interest.

- Have incentives to sell his or her own higher-fee products.

- Earn commissions on the new product, thus possibly clouding his or her judgment.

The key here is that a non-fiduciary will recommend a suitable financial product. He or she is not obligated to offer a product that’s in your best interest.

In fact, he or she may be incentivized to sell you a product that is an in-house product – one that offers a higher commission.

How Can I Tell If an Advisor Is Working in My Best Interest?

Simply ask, “Are you a fiduciary?”

Yes, it’s that simple.

You can take it a step further and ask if the advisor is willing to sign a disclosure stating he or she is a fiduciary.

This is where the rubber meets the road.

A fiduciary will glady sign.

If an advisor steps back and asks why you want him or her to sign something, that’s a red flag.

Download This Fiduciary Pledge for Your Advisor to Sign

Other Questions to Ask an Advisor

Are you independent or do you work for a firm?

If the advisor is an independent fiduciary, legally he or she must recommend the best available products for you.

If the advisor works for a firm, you have to decide if there is a conflict of interest – as he or she may be inclined to or have to push the firm’s own proprietary products, some of which may have higher fees.

Some firms have a commission-based side of their business and a fiduciary side. These are often referred to as hybrid firms.

The question you need to ask a fiduciary who works for a firm is this: When you choose my investments, are you wearing the fiduciary hat that puts my interest first or the suitability hat, where the loyalty lies with the firm?

Who makes the decision regarding my investments, you or your firm?

The answer is similar to the above.

As an independent fiduciary, it’s all about the client.

If you’re interviewing a fiduciary who works for a firm and has multiple licenses, it could go either way.

As the consumer, you need to feel that level of trust.

You are building a long-term relationship with someone you are trusting with your financial future. You have to feel good about it.

How are you compensated? Fees or Commissions? Or Both?

A fiduciary advisor should tell you exactly – and in clear terms – how he or she is compensated.

Fiduciaries either charge a flat fee or receive a fee for the percentage of assets. This puts them on the same side of the table as you.

If an advisor gets a commission, he or she only has to find a product that’s suitable for you. This may create a conflict of interest because the advisor may be inclined to choose a suitable product that offers a higher commission.

If you ask an advisor how he or she is paid, and the response is, “My company pays me, so you don’t have to,” this means the advisor is being paid a commission on the product.

Is their judgment clouded because of the commission? Chances are, yes.

Does your firm receive backdoor payments from custodians or fund families?

Many firms receive backdoor payments for recommending certain funds, fund families, or even custodians.

Sometimes these are called revenue-sharing agreements. Just google the term revenue-sharing agreements, and you’ll see massive class action lawsuits against companies that do this.

Fiduciary advisors can have backdoor payments, but they must disclose them to you, and you have to sign off on it.

Pingback:How Financial Advisors Get Paid - Stop Being Sold

Posted at 22:49h, 15 February[…] fiduciary advisor is an investment adviser who works under the Fiduciary Standard, which means they must put their […]

Pingback:Fiduciary vs. Suitability Advisors: What's the Difference? - Stop Being Sold

Posted at 19:24h, 15 March[…] [Related Read: Why Working with a Fiduciary Is CRITICAL to Your Financial Future] […]