29 Oct Working While Collecting Social Security Benefits [Avoid This Costly Mistake]

If you are working while collecting social security benefits, there are rules you need to be aware of.

Failure to adhere to these rules may result in your missing out on money or having money subtracted from your Social Security benefits.

There is a limit on how much you can earn and still receive full benefits based on when you start taking the benefits.

If you’re younger than full retirement age and you’re working while collecting Social Security benefits, there are some limitations on how much you can actually earn without being penalized by the Social Security Administration.

Keep reading to find out what the 2022 Social Security rules are to ensure you aren’t penalized for making too much.

Retirement Isn’t What It Used to Be

I don’t know about you, but my grandma didn’t go to pilates 3 times a week, work a part-time job, or travel the world with her girlfriends.

Instead, she stayed at home a lot and worked crossword puzzles, traveled with grandpa, and she seemed much older than most retirees I know today.

Retirement has changed. People are living longer. And how we as a society define aging (and thus retirement) has shifted tremendously in the last decade.

In fact, a TD Ameritrade survey found 73% of women said 70 is the new 50, while 59% of men said the same.

People are also working longer.

Whether it’s because retirees have to work or simply want to work, the fact is more people are working past full retirement age.

According to a 2021 American Advisors Group survey, 46% of those surveyed aged 60 to 75 said they plan to work part-time after they retire.

Not a problem…unless you are working while collecting Social Security benefits and have not yet reached full retirement age.

Avoid This Costly Social Security Mistake

One of the biggest mistakes made in Social Security is not understanding what the penalties are prior to full retirement age, should you decide to take early benefits.

After full retirement age, you don’t have to worry about the penalties for working while collecting social security benefits.

After you reach full retirement age, you can make as much as you want and still receive full benefits.

However, if you are younger than full retirement age (which is based on the year you were born) and you are collecting Social Security prior to that age, there are some limitations on how much you can actually earn.

Let’s say you were born between 1943 and 1954 and your full retirement age is 66. You can start your Social Security benefits as early as age 62, but won’t receive full benefits.

Continuing with the example above, let’s say you are 64, and you start collecting early benefits while you’re still working.

For 2021, the limit that you’re allowed to make monthly is $1,580 a month of income, or $18,960 for the year.

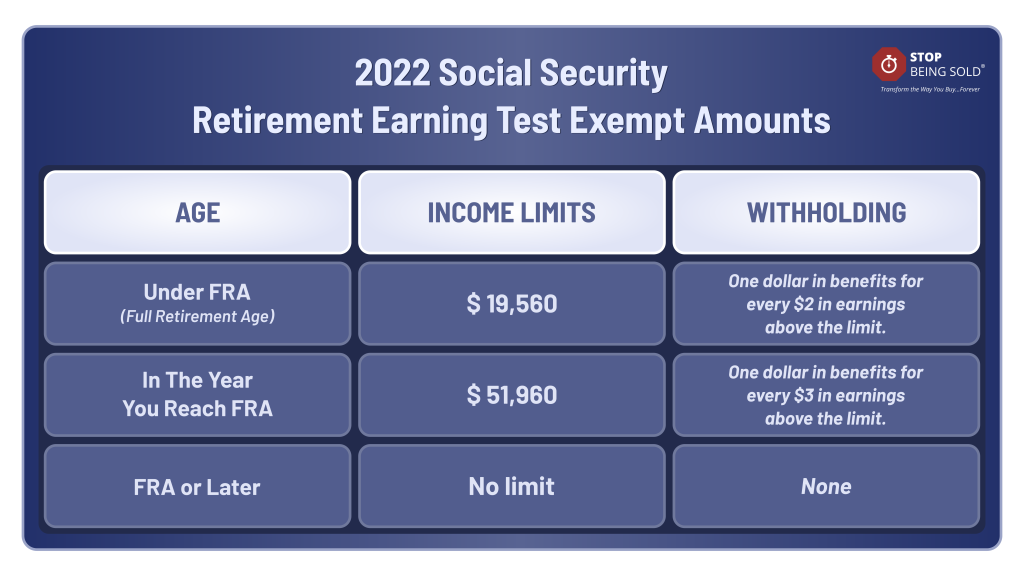

For 2022, the limit is $1,630 per month and $19,560 for the year.

If you’re working while collecting Social Security and you earn MORE than this amount, you will be penalized.

The Social Security Administration will deduct one dollar from your benefit, so if you receive $600 a month in benefits from Social Security, they will take $1 for every $2 you earn over the annual limit.

Depending on how much you make, this could be a substantial amount.

For 2021, the annual limit is $18,960. So, if you make $20,000, you are over the limit by $1,040.

This means that $520 in total would be subtracted from your benefits for the year. That amount is divided by 12 months.

With the 2022 Social Security updates that were announced on October 13, the limit has risen to $19,568 per year.

If you’re working while collecting Social Security, it’s imperative you take the time to figure out how much you will earn based on the threshold limit.

If you don’t plan, you may be missing out on money OR have money subtracted from your benefits.

Warning: If You Plan on Retiring in the Next Year

Another reason Social Security planning is critical to your financial future is because the earnings limit applies to the year you retire.

Let’s say your full retirement age is 66 and 2 months and you plan on retiring in November of 2022.

In 2022, if you have a full-time job, you may want to wait until January 2023 to fully retire and collect full Social Security benefits.

Because if you work up until November 2022 and make over $51,960 (which is the Maximum Earnings Test Exempt amount for 2022), you will have already made too much money for the year.

If you exceed this amount in 2022, $1 in benefits will be withheld for every $3 in earnings above that limit.

Again, this is why Social Security planning is necessary. Why give the money back if you don’t have to?

Pingback:7 Reason Why Taking Early Social Security Benefits Is Beneficial - Stop Being Sold

Posted at 22:28h, 14 December[…] [Related Read: Working While Collecting Social Security Benefits – Avoid This Costly Mistake] […]

Pingback:3 Critical Changes to Social Security in 2022 - Stop Being Sold

Posted at 21:24h, 20 December[…] [Related Read: Working While Collecting Social Security Benefits – Avoid This Costly Mistake] […]

Pingback:3 Strategies to Maximize Social Security Benefits - Stop Being Sold

Posted at 04:05h, 17 January[…] [Related Read: Working While Collecting Social Security Benefits – Avoid This Costly Mistake] […]

Pingback:How to Plan for Social Security in 2022 - Stop Being Sold

Posted at 04:28h, 15 February[…] [Related Read: Working While Collecting Social Security Benefits – Avoid This Costly Mistake] […]