28 Sep 24 Financial Mistakes I’ve Seen in My 23 Years as a Financial Advisor

Article Highlights

In my 23 years as a financial advisor, I’ve seen more financial mistakes than I’d like to admit. Whether it’s holding too much cash or failing to keep accurate investment records – I’ve seen it all.

To help you reach your financial goals faster, I’ve compiled the top 24 financial mistakes I see consumers making over and over again.

My advice is to read through this list and note which ones you’re making. Then, create a plan for how you will correct your financial mistakes.

#1 People Don’t BUY Financial Products. They Are SOLD Products.

Most people don’t shop for financial products. They don’t wake up and say, “I think I’ll buy an IRA today.”

Instead, they are sold financial products.

Someone comes their way and sells them something, which may or may not be the best fit for their financial situation.

As a result, I’ve had countless clients come to me with horror stories about being sold the wrong life insurance or investment products.

Or worse, falling for financial products or schemes that are too good to be true. This is especially true for the 60+ crowd, who are anxious because they are quickly approaching retirement and don’t have enough money saved.

Another financial mistake this group makes is getting too aggressive and expecting to hit a home run when they hit a ball.

They chase high-yield investments with unrealistic returns. They have a mindset that they need to be more aggressive now because they screwed up.

#2 Not Understanding What You’re Invested In.

This financial mistake is far too common among prospective clients I’ve met over the years.

Far too many people do not understand the financial products they own. Nor do they understand the purpose.

Take life insurance, for example. If you own a policy, do you have a clue what the product actually does, why it was right for your particular situation, or why you bought it in the first place?

What about that IRA? Do you know why you’re invested in a ROTH vs. traditional IRA?

If you’re invested in financial products you don’t understand, I highly recommend researching each product, and then reaching out to an expert to get your questions answered.

#3 Not Keeping Accurate Records.

This financial mistake is a big one! And it can be avoided in an afternoon’s worth of work.

I cannot tell you how many people have come to me with a brown paper bag filled with 401(k) statements and life insurance policies.

Or how many clients’ homes I’ve been to where their paperwork was tucked in a drawer.

It’s vital you keep accurate records stored somewhere that’s fireproof and in a place that someone in your family is aware of.

When people pass, often their spouses or kids have no idea these financial assets exist. And, as a result, may throw them out.

This happened to my family when my wife’s grandmother passed. We were cleaning out her house after her funeral and found silver and gold coins tucked away in pill bottles!

Once we found this treasure, we had to go back through everything. And, it’s a good thing we did!

We found silver certificates wrapped in bacon in the freezer and money sewn in her clothes.

#4 Not Getting Expert Advice.

There’s nothing wrong with doing it yourself. Nothing at all.

However, when it comes to your finances, your retirement, and your assets you want to leave to your loved ones, it’s advisable to speak with an expert.

Whether it’s a tax professional, estate planning attorney, and/or financial advisor, seek advice about the best ways to grow your wealth and protect your finances.

#5 Failing to Ask the Right Questions.

Not asking the right questions when meeting an advisor (or failing to ask any questions at all) often leads to people investing in policies and products they don’t understand.

I had a client named Jeannette. I first met her when she came to a workshop I hosted. After the event, I met with her one-on-one, and she had a yellow notepad 4-6 pages long of questions to ask.

She interviewed me as an advisor. And every time I see her, she has new questions.

This is how you are supposed to interview your financial advisor.

Yet, less than 1% of the thousands of clients I’ve met with, actually do this.

Here are a few prompt questions for you to ask – whether it’s your current advisor or you’re interviewing a new one:

- How did you come up with this financial solution for me?

- What was your criteria for selecting this policy or product?

- Why do you recommend this specific policy or product?

- How do you get paid on the product you’re offering me?

- Do you have references I could speak to? Specifically, other clients with situations similar to mine.

Be like Jeannette and make a list of questions before you meet with an advisor.

Remember, when it comes to your financial future, there are no stupid questions!

#6 Not Enough Savings.

I’ve seen this financial mistake cause more trouble for people than I want to admit.

If an emergency pops up (and it will because we’re living this thing called life), do you have enough savings to cover it and not go into debt to take care of it?

Emergency savings are next week’s paycheck!

#7 Keeping Too Much Cash.

Many people don’t realize that when they have cash on hand, they are failing to allow their money to work for them.

While it is a good rule of thumb to keep 6 months’ worth of expenses in cash, anything after that should be placed in a vehicle where it can make you money.

I have one client with 180k sitting in cash (she refuses to do anything with it). And since it is cash, she is not earning any interest on it.

Not only is she missing out on compounding interest, but she will also run into an issue with banks calling to sell her more products because banks are trained to call you after hours if you have 25k in an account.

#8 Letting CDs Roll Over.

Another common financial mistake is letting CDs (certificate of deposit) roll over automatically.

This happens often because banks automatically roll over CDs (though they do give notice).

Sure, it is easy and convenient, but when the bank automatically rolls over the CD, it is renewed at your current interest rate. If the new rate is lower than the original interest rate, you’re missing out.

Before your CD is up, shop around to find better interest rates and options.

#9 Failing to Invest Enough.

In a Schroders US Retirement Survey, only 27% of respondents said they feel very good and fully on track about their retirement.

That leaves the majority unprepared for the future.

Of those near or at retirement (ages 60-70), only 26% said they have enough saved for retirement.

60% said they were not prepared, and 7% said they did not know.

Don’t let this happen to you.

Instead, start investing sooner rather than later and invest consistently enough to see some rewards.

Acorns provides this example: “If someone had invested as little as $1 per day for you when you were born, that would’ve grown to $13,000 by the time you turned 18, assuming a 7% annual return.

Even if you never added another dollar, that amount could swell to about $410,000 by the time you’re ready to retire.”

#10 Failing to Put Savings and Investments on Autopilot.

Unfortunately, many people miss out on saving more because they tell themselves they will take care of it one day…but one day never happens.

Instead, allow your bank to automatically transfer money to your savings or your company to automatically invest in your 401(k).

Note – While autopilot is better than never saving or investing, it is still wise to regularly check accounts and investments. You want to know what your money looks like so you can make savvy financial decisions.

#11 Not Funding a 401(k).

A financial mistake that makes me want to scream is learning that someone hasn’t funded their 401(k).

If your company offers a workplace retirement plan, make sure to enroll and contribute a percentage of each paycheck to fund it.

While you’re at it, make sure you contribute what you can to receive a company match. This is free money that you may otherwise miss out on.

#12 Not Reading Investment Statements.

Many people treat financial statements like junk mail.

These are not junk mail. They are incredibly helpful tools for getting an idea about your financial future.

Opening and reviewing these statements allow you to see if you are on track with your retirement and savings goals.

#13 Failing to Track Expenses.

A common financial mistake is failing to budget or have a way to track expenses. Instead, many people simply deposit their paychecks and then spend the money.

Without a budget, they have no idea where this money is going…and are often surprised to learn they are living beyond their means.

If budgeting isn’t your thing, there are numerous online tools that will track expenses for you.

Check out Mint, a free online budget tool, that simplifies budgeting and tracks spending. Mint will automatically create a personalized budget based on your spending patterns.

#14 Overspending to Keep Up Appearances.

With Instagram and Facebook, it’s become even more important for people to feel as if they need to keep up with the Joneses.

The problem is, more often than not, these people don’t have the same financial situation as the Joneses.

For some of those trying to keep up, they wind up house poor, bankrupt, or relying on their children in their retirement years because they prioritized keeping up appearances rather than saving and investing for the future.

#15 Not Saving for Big Purchases.

We live in a time when we can get anything we want as soon as we want it. With the touch of a button on our phones, we can have food delivered in a matter of minutes.

The problem is that some people have this same fast-food mindset when it comes to big purchases.

They rush and make hasty decisions to splurge on cars, vacations, and new homes instead of saving for these purchases.

We should be taking our time to save up for these things, as well as research to find the best deal for our money.

#16 Carrying Too Much Bad Debt.

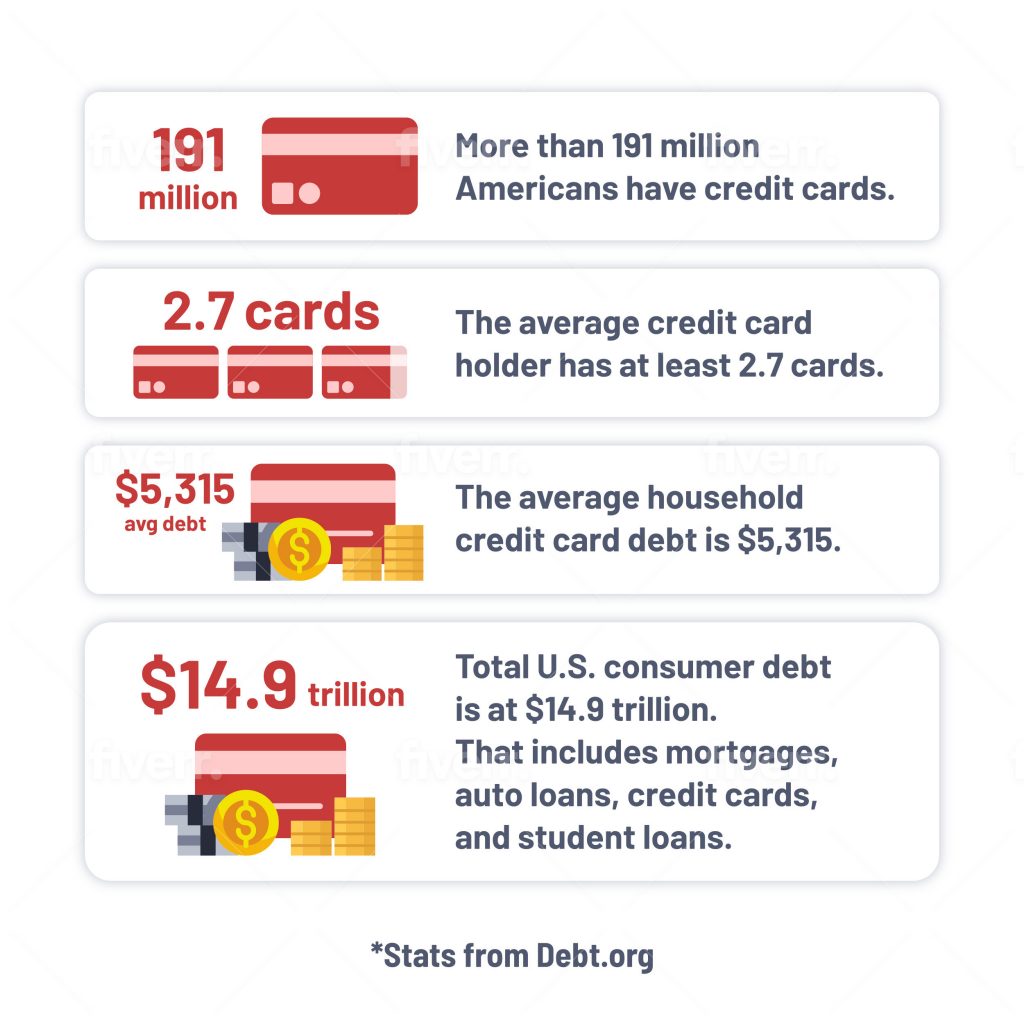

Debt is a problem for most Americans.

Credit card debt is bad debt. You wind up paying a significant amount of money due to high interest rates.

Anytime you use a credit card or take out a loan with a high interest rate, you put yourself in the danger zone.

Ideally, you should only use a credit card if you plan to pay it off monthly to avoid paying high interest rates.

#17 Paying Huge Fees to Get Tax Refunds Sooner.

Another financial mistake that comes about because of our fast-food mindset is paying huge fees to tax refund advance programs to get our refunds sooner.

Companies, such as car dealerships, will entice you with the ability to drive your new car right off the lot today if you agree to the tax refund advance program.

It sounds too good to be true – because it is.

They charge a huge fee to do so.

Since you know you will be receiving the refund in 2 – 3 weeks, why waste the money on this fee?

#18 Not Enough or Too Little Life Insurance.

Unfortunately, one of the more common financial mistakes is having the wrong mindset when it comes to life insurance.

On one hand, you have some people who don’t get enough because they don’t see its importance.

On the other hand, you have some people who plan to use the life insurance money to fund their next husband’s sports car.

The purpose of life insurance is to help those you leave behind by replacing income loss.

[Related Read: How Life Insurance Works: What You Need to Know]

#19 Not Shopping Insurances Annually to Cut Costs.

Many people don’t realize they are overspending on insurance. Insurance rates change year to year, and you can (and should) shop around to find better rates.

Experts suggest shopping insurances annually to find better deals.

Gabi is an online insurance broker and agent that will do all the research for you. Once you compare the various rates, you can purchase insurance through Gabi.

#20 Rushing after a Death in the Family.

Sadly, many people make financial mistakes after the death of a loved one. And some people make rash decisions that wind up hurting them in the long run.

A friend of mine lost her dad at a young age. As the sole beneficiary, she suddenly had more money than she dreamed possible. She blew through it and had to get a financial conservatorship.

This story is more common than you think.

Other people don’t take time to grieve or process the loss and their new life circumstances, which results in making financial mistakes.

#21 Having Only One Source of Income.

You put your financial future at risk if you put your eggs all in one basket. Instead, you need to have multiple streams of income.

For instance, how many people put their whole retirement in one company when they can cut benefits, pension, health, etc?

It’s unwise.

Instead, diversify your investments.

#22 Have Little or No Passive Income.

The secret millionaires know is that passive income is the key to success and financial freedom.

They enjoy the beauty of earning money in their sleep.

Find opportunities to make passive income, such as building a lucrative side hustle like a blog or investing in real estate.

#23 Not Checking Credit Scores Often Enough.

The better your credit score, the better the interest rates you receive.

People with good credit scores typically get offered lower interest rates on credit cards, loans, insurance, and more.

But many people don’t check their credit scores often enough.

This is a mistake for two reasons.

First, it is wise to get a credit report to make sure you haven’t been the victim of credit card fraud or identity theft.

Next, mistakes happen. You could find a mistake on your credit report that has hurt your score.

Simply by having this mistake corrected, you can boost your credit score.

#24 Afraid to Spend Their Money in Retirement.

Another financial mistake people make is not spending money in retirement.

Often, people are afraid they will run out of money or won’t have any money to pass on to their children.

There are solutions to these fears, such as lifetime income products.

Another option is buying life insurance to leave to your kids, so you can spend your retirement.

No Comments